VAT for Customers located in the European Union

For service providers that are located in the European Union, we have implemented an automatic validation of their customers' VAT information.If they have customers that are VAT registered in an EU member state, the system checks the validity of the customer’s VAT number by calling the V.I.E.S web service. This validation is applied during the customer registration from inside the Storefront and when a new account is created in Cloud BSS.

(Validation of EU VAT number during self-registration in Storefront)

If Cloud BSS receives from V.I.E.S that a VAT number is invalid, it allows the registration of the customer, but:

- It keeps a notion in the account details that the account's VAT number is not valid.

- It does not exclude this account from VAT tax.

Important Notice

The validation of the VAT number is performed using the V.I.E.S. web service provided by the European Union. V.I.E.S. does not maintain itself a VAT number database. Instead, it forwards the VAT number validation query to the database of the concerned member state and upon reply, it responds to the inquirer with the information provided by the member state. This means that if a company hasn’t informed the local tax authorities that provides goods to the rest of the EU members, it cannot be validated by the V.I.E.S. system.

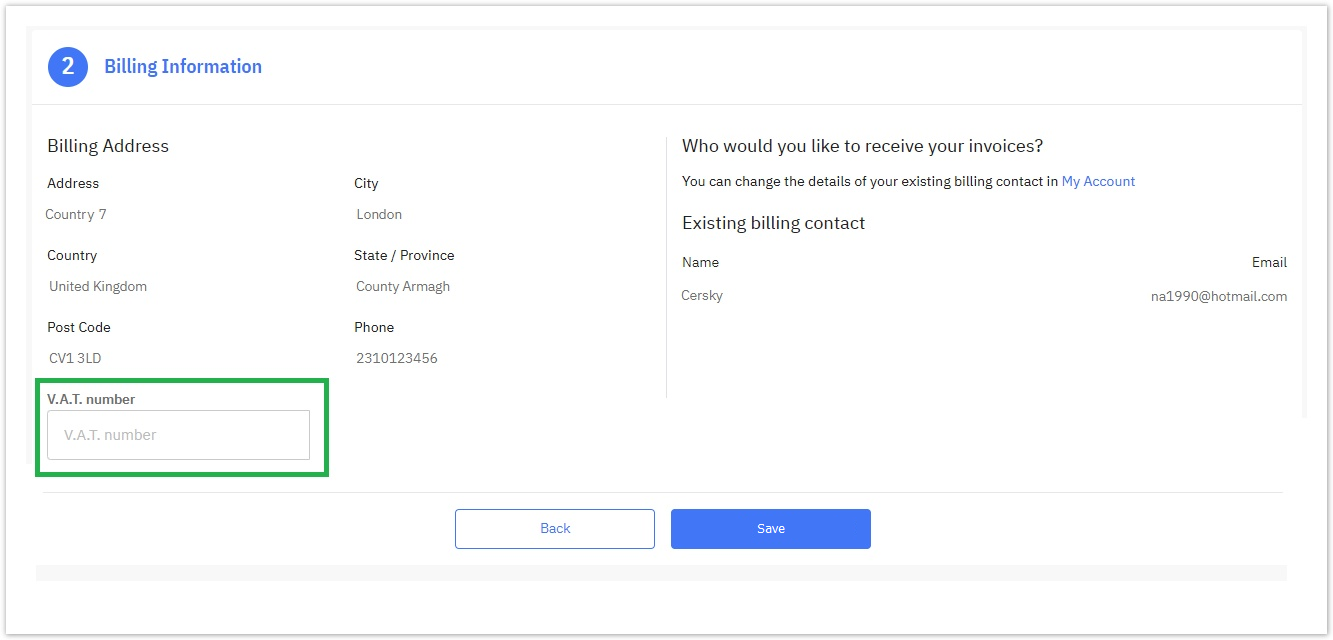

VAT Field During Storefront Checkout for European Union Customers

When a customer checks out one or more products in the Storefront and his billing address is located in a European Union Country, then during the checkout process, the value-added tax (VAT) number field is being displayed on the Billing Information step (step 2 of the checkout process), the same way it is displayed on the registration page of Storefront.

More specifically:

The field named "V.A.T. number" appears below the Billing address for the European Union countries (except Greece). If the user has already filled in this field at the Storefront registration page (found under the name “EU VAT Information”) or when creating a new account on BSS (found under the “Registration number”), the VAT field is going to be prefilled during the Storefront checkout Billing Information page. Otherwise, the user may fill in this field.

This field gets validated through V.I.E.S. web service when focusing out of the VAT field. The checkbox option responsible for that validation must always be enabled and can be found by navigating to BSS Setup > System Options > Taxes and after locating the proper EU tax click on it and make sure that the checkbox named "Exclude for EU Customers" is enabled. The checkout process proceeds normally in both cases and the VAT number is saved on the account's VAT field on "My Account" in the Storefront as well as on the respective BSS Account.

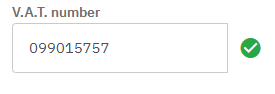

When the V.A.T. number typed is correct and the service returns a successful validation, you will see a checkmark on the right-hand side of the field:

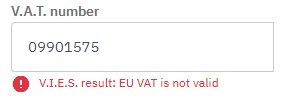

Whereas when the V.A.T. number typed is incorrect, you will see an exclamation mark accompanied by the message"V.I.E.S. result: EU VAT is not valid" message on the bottom part of the field:

Exclude VAT for European Union Customers

Concerning the "V.A.T. number" field located under the Billing Information step of the Storefront's checkout process, we have introduced the option to exclude VAT for the European Union customers. This option can be enabled from within the BSS Tax of your preference and applies only to European Countries. By navigating to BSS Setup > System Options > Taxes, you can find a checkbox named "Exclude for EU Customers" where you can enable it.

Consequently, when purchasing from a Storefront of a different European Union country than the one you are in, and this checkbox is enabled, the Storefront User with a valid VAT number will not pay taxes. Further analysis follows below.

Analysis of Validation Rules for EU VAT Exclusion for European Union Customers via V.I.E.S

- A customer from an EU country, having a valid VAT (according to V.I.E.S result), purchases from the Storefront of the same EU country: In this case, the taxes are always applied regardless of the activation of the “Exclude this tax for EU customers with valid VAT number” checkbox in the BSS Tax setup.

A customer from an EU country, having an invalid VAT (according to V.I.E.S result), purchases from the Storefront of another EU country: In this case, the taxes are always applied regardless of the activation of the “Exclude this tax for EU customers with valid VAT number” checkbox in the BSS Tax setup.

A customer from an EU country, having a valid VAT (according to V.I.E.S result), purchases from the Storefront of another EU country: In this case, if the checkbox “Exclude this tax for EU customers with valid VAT number“ in the BSS Tax setup is disabled, taxes are applied.

A customer from an EU country, having a valid VAT (according to V.I.E.S result), purchases from the Storefront of another EU country: In this case, if the checkbox “Exclude this tax for EU customers with valid VAT number“ in setup is enabled, taxes are excluded.

The synopsis of the validation rules is that if the checkbox “Exclude this tax for EU customers with valid VAT number“ is enabled and the EU customer purchases a service from the Storefront of another EU country, his VAT must be valid (according to V.I.E.S.), in order for the tax to be excluded from that purchase. In any other case, the tax will be applied.

On the Billing Information step of the ordering process, the "V.A.T. number" field may be editable if any one of the compulsory billing address fields is empty or not valid. Since in this case, all fields are editable including the "V.A.T. number" field, you can enter a different V.A.T. number.

In such cases, the Checkout button is renamed to "Save" and when clicked, the page refreshes and all calculations are performed again (if needed). The reason behind the recalculation is the change of the validity status of the "V.A.T. number" (which is triggered by either a change of V.A.T. or a change of Country).

So when the "V.A.T. number" is invalid and is changed to a valid one (based on V.I.E.S. check) and vice versa, the taxes are calculated again for this order.

- If the newly calculated taxes are the same as the ones that the draft order had previously, nothing changes.

- If the newly calculated taxes are different from the ones that the draft order had originally, a message appears informing you of the change of the final amount: "Price is recalculated based on the update of the V.A.T. number. New Total Amount is € xxx".

Consequently, with the aforementioned rules, this validation factor is taken under consideration, along with all the other parameters indicating the Account's and product's taxation.

When all fields of the Billing Information page (2nd step) are filled in, upon clicking on the "Next" button, the "V.A.T. number" field is stored automatically as the “Registration number” of the BSS account of the billing account, and the checkout process progresses normally.